IMPACT INVESTOR INSIGHTS

5 Impact Investing Trends From 2017

Impact investing drives social and environmental progress through investments, while screening for risk and creating competitive returns….

Event Photos: SRI Leaders Panel 2017

We had a nice turnout for the recent happy hour event hosted at our San Diego office, featuring four dynamic panelists who are leading…

Leading the Sustainable Finance Movement

The 28th annual Conference on Sustainable, Responsible, Impact (SRI) Investing is being held in San Diego this year, for the first time…

Coaching Financial Professionals on Investing with Impact

Impact Investors’ Principal Advisors Catherine Woodman and Shane Yonston have recently been invited to speak at industry conferences as experts in Sustainable, Responsible, Impact (SRI) investments, to share their combined 30 years of experience serving investors with...

Shareholder Advocacy in 2017

Spring marks the beginning of new activities each year such as gardening and baseball. For investors, spring is also the start of “proxy season” – a period when companies hold annual meetings for shareholders to review business activities, as well as to vote on...

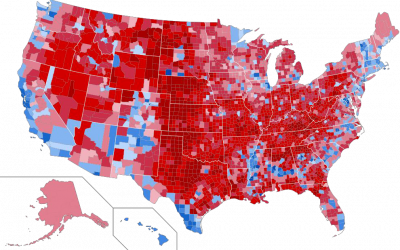

Portfolio Strategies for a Trump Administration

With uncertainty dominating the discussion about how Trump’s policies might affect the economy, the market has reacted initially with a positive trend toward the close of the year. Key factors indicating possible volatility and a rough road ahead for groups interested...

SRI v. Impact Investing – What is the difference?

Impact Investing is a relatively new term with roots found in the practices of the Socially Responsible Investment (SRI) industry going back hundreds of years. While the term has gained popularity, there has been a fair amount of debate amongst practitioners and...

Fossil Fuel Free Investments

It is becoming clear to shareholders and companies alike this proxy season that “business as usual” is no longer a viable strategy for 21st century businesses. Recognizing the urgency facing businesses and the public to respond to climate change, As You Sow filed an...

Market Rebound From Worst Start in History?

Not Out of the Woods Yet! The first quarter of 2016 was anything but boring. Fears of potential recession caused U.S. stocks to fall more than 10% in just the first 10 days of the new year. By quarter- end, U.S. stocks bounced back into positive territory as the...

Career Management for Millennials

Running those calories off! If anyone has watched SNL’s skit “The Millennials”, they’ll know the gag runs on the stereotype of spoiled young adults spending their time texting and traveling instead of working. The joke appears to be further bolstered by the fact that...

Market Outlook 2016

In addition to protecting from downside risks, managing portfolios involves constantly looking for opportunities to shift assets into undervalued positions. Looking forward, here are some of the areas we see may yield such opportunities: China: The nascent, volatile...

The Great Panic of 2016

Wow! There’s no diplomatic way to say this: the global stock markets are in panic mode right now. In two weeks of trading, the U.S. S&P 500 index is down 8% on the year, which brings us close to correction territory (a 10% decline), and has some predicting a...