Impact Investing is a relatively new term with roots found in the practices of the Socially Responsible Investment (SRI) industry going back hundreds of years.

While the term has gained popularity, there has been a fair amount of debate amongst practitioners and observers alike, as to whether we need yet another idiom in the already jargon-ridden field. We contend that framing investments alongside their impact, is actually quite beneficial to both investors and the overall marketplace, while in fact improving mainstream clarity, unlike a lot of financial terminology.

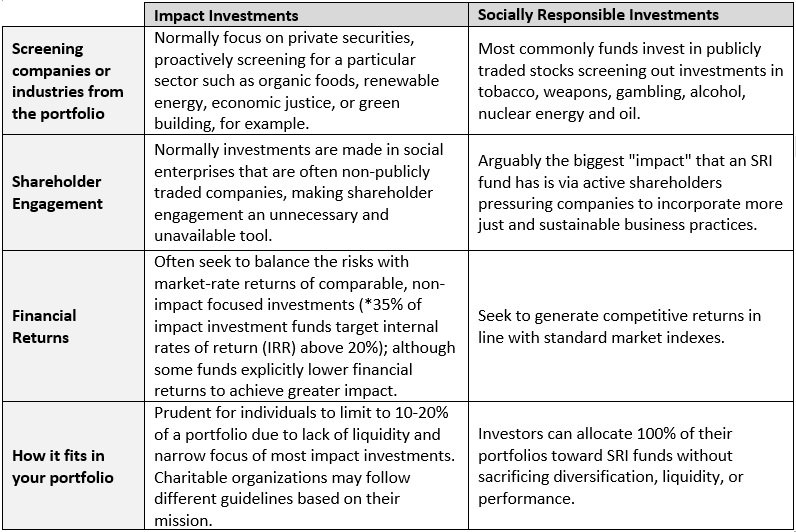

In general, both SRI funds and Impact Investments seek to achieve competitive financial returns while making the world a better place. That said, the approach they take to achieve these objectives creates at least four ways in which they are commonly different, as shown in the chart below.

In addition to the characteristics noted in the chart, Impact Investment funds are often focused on measuring their effects on society and the environment, in addition to their bottom line financial returns. For example, an impact investment in renewable energy infrastructure might measure and report on how many tons of carbon are being replaced by the solar farms and wind mills in the portfolio, while paying investors a 6% tax-efficient income stream. Or an international loan fund might measure how many fair jobs are created for economically challenged communities while distributing a 7% yield to shareholders.

The next iteration of Impact Investments, let’s call them Impact 2.0, promise to offer us a more standardized, streamlined reporting on their environmental and social impacts. This type of reporting of financial returns side by side with global impacts, is already increasing transparency and investor awareness, leading to improved decision-making and a more efficient marketplace overall. Plainly put, as Impact Investing evolves, we may more consciously direct our capital to meet our financial goals in a way that also supports a desired overall impact in our communities.

We believe that utilizing a combination of both Socially Responsible and Impact Investments today, can be a powerful method for investors to manage their money in a prudent manner, to achieve a tomorrow they can feel good about.

*World Economic Forum: 2.2 Areas of Definitional Confusion