With uncertainty dominating the discussion about how Trump’s policies might affect the economy, the market has reacted initially with a positive trend toward the close of the year.

Key factors indicating possible volatility and a rough road ahead for groups interested in social and environmental justice were highlighted at this year’s annual SRI Conference held in Denver, Colorado. In this article, we reflect on several factors that may affect portfolios over the next four years. If interested in our strategy for a Trump Administration in your portfolio, contact us by email to learn more.

Our Economy

The first day of the 2016 annual SRI Conference started with a broad, macroeconomic overview presented by Mel Miller, Chief Economist at First Affirmative Financial Network. In line with his long- standing annual tradition, Miller integrated a few humorous slides between discussing macro- economic trends that President Trump will be challenged with, in a way addressing the intensity of the election and what results would mean for our various communities across the country.

One such trend that Miller depicted was the demographic era we are presently entering, during which only 25% of the American population will be supporting the other 75% between the ages of 0- 18 and over 65. This demographic age gap creates a historically high burden on the working class to generate enough tax revenue to support ongoing services for those who are either still in school, out of the work force, or in retirement. It is unclear how these services will be sustainable if Trump’s tax cut proposals are implemented.

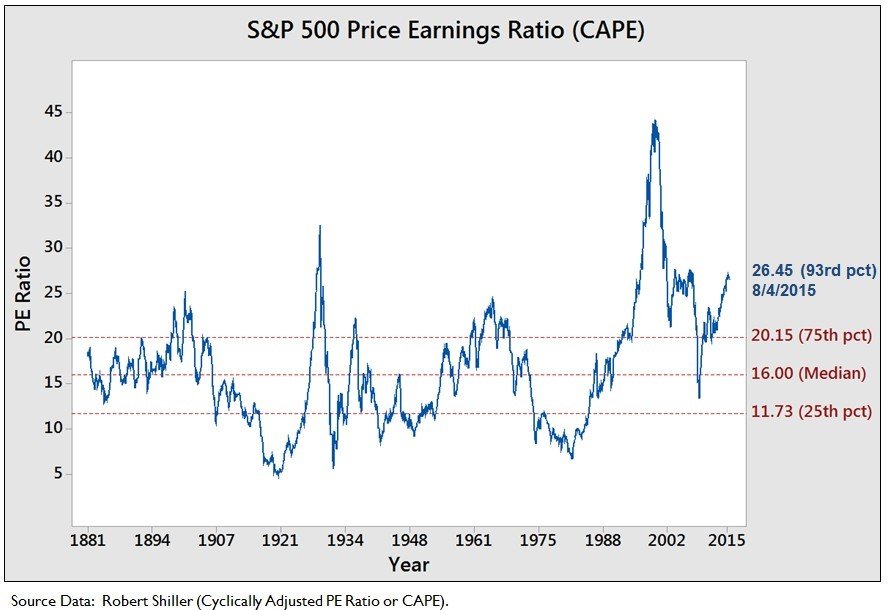

Miller also pointed to the S&P 500 Price to Earnings graph below, showing the historically high stock prices relative to earnings; the third most inflated in history, in fact at 26.45 versus the median of 16.00.

If corporate taxes decline however, net income would go up and the Price to Earnings ratio would drop. However, given that Trump campaigned on an isolationist platform of bringing jobs back to America, we can expect a decline of imports into America. Therefore, a likely retaliatory rise in tariffs imposed upon American companies selling overseas could lead to a global slowdown in free trade. Might the unfolding terms of Brexit along with Trump’s isolationist trading policies lead to the unraveling of the EU’s system? What sorts of buying opportunities might there be in countries best poised to rebound after separating from regional trade agreements?

Our Energy Sector

Another excellent keynote at the SRI Conference was presented by Dr. Holmes Hummel, PhD from Stanford and Founder of Clean Energy Works. Hummel served as the Senior Policy Advisor in the U.S. Department of Energy’s Office of Policy & International Affairs from 2009 to 2013 and now focuses her work on ways to interpret global energy scenarios to highlight valuable insights for investors and policy-makers.

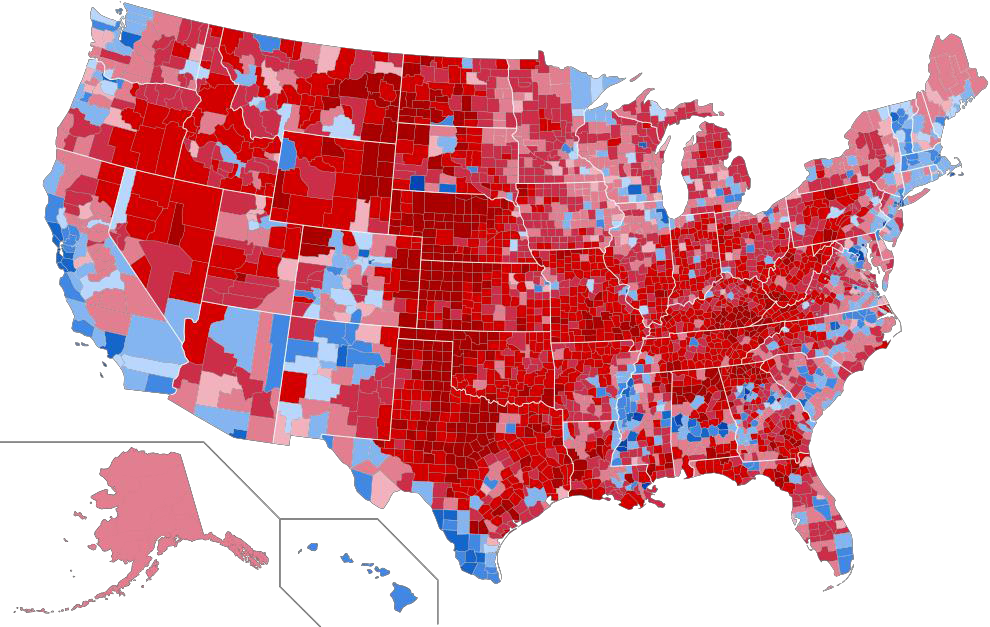

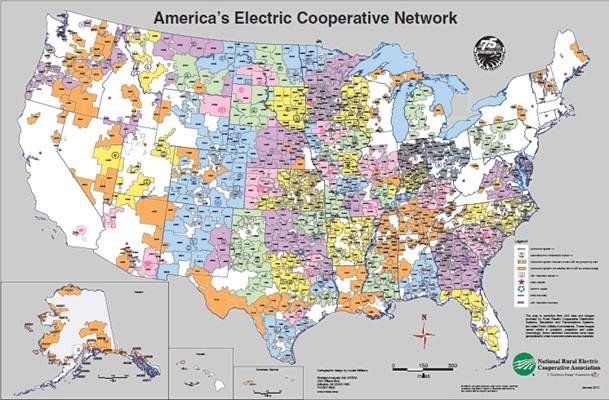

Hummel pointed to the high degree of correlation between Trump’s Electoral Vote Results Map and the areas of our country with cooperative utilities.

Source: Wikipedia – United States Presidential Election 2016

Cooperative utilities with a more local ownership structure, which serve 68 percent of US consumers, have broader priorities than traditional utility companies.

Pay As You Save (PAYS) is a financing intervention used in rural middle-income markets, and one that she champions, by enabling utility customers to purchase and install cost-effective energy efficiency upgrades without upfront payment, personal loans, or property liens. The payback is made over the years to come with savings and renewable energy credits. Hummel said that focusing on rural cooperatives and municipal utilities as an “entry point into the sector”, hopes to address the clean energy future.

Hummel claims that undertaking these retrofits would stimulate $100 billion in localized economic investments and create thousands of living-wage jobs. Some have even argued that expanding energy efficiency retrofits in the middle-income market is the key to building broad-based political support for federal climate change legislation.

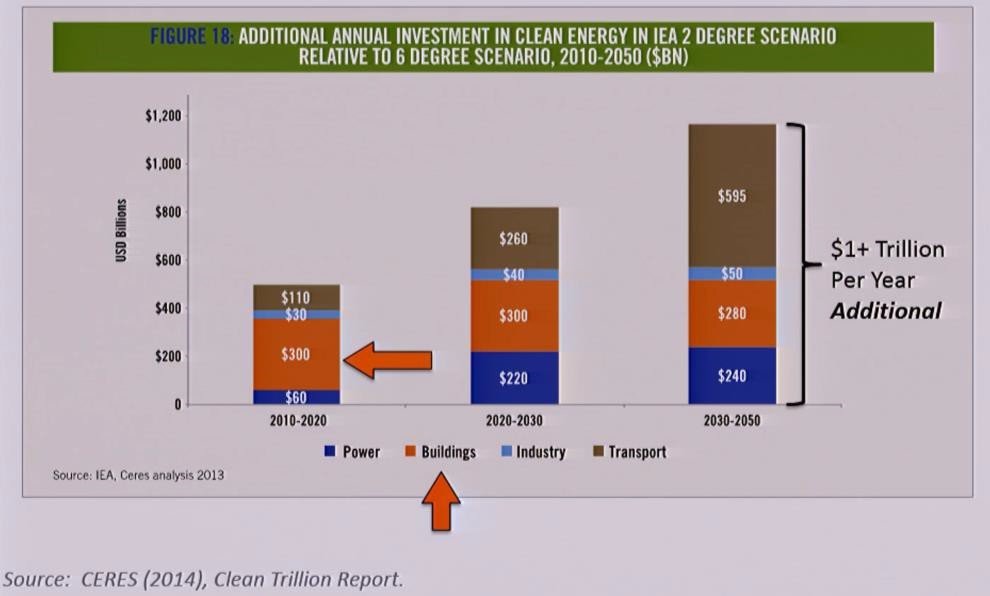

Also, Hummel noted the need for $1 trillion investment per year in the clean energy sector to maintain the impacts of climate change to a 2 degree Celsius increase in global temperature.

However, Trump’s promise to pull out of the Paris Climate Agreement and his appointment of one of the best-known climate skeptics, Myron Ebell, to oversee the EPA signals the start of a significant shift in Federal energy policy. Indeed, we expect that Obama’s Clean Power Plan will be dismantled, ending the US’ core commitment in the Paris Agreement. Although the federal government is pulling away from supporting growth and innovation in the renewable energy sector, Forbes’ contributor James Conca echoes the assessment that most of the push for renewables, and many of the financial incentives, come from states and local municipalities anyway.

Conca notes that even more, Congress already extended the renewable energy Production Tax Credit to 2021 and that the market fundamentals of wind and solar have entered an age when they can compete on price in a de-regulated environment. So, it seems that even if we don’t advance our technology or hit the volume targets needed to keep the worst effects of climate change at bay, the industry of solar and wind will remain an important part of our energy plan in the years ahead.

Our Financial System Modern Portfolio Theory, the ubiquitous principle to “diversify, diversify” used by money managers around the world, was created in the 1950s. Since then, the global economy has changed significantly.

Historically, investors would diversify from U.S. stocks by holding real estate, hedge funds, high-yield bonds, and natural resources. The hope would be that even if some asset classes dropped that others would rise or at least move independently. This is an inverse or low correlation. However, as the Investment Management Consultants Association (IMCA) notes in their published paper on the topic, Understanding The Recent Rise In Correlations And How You Can Turn It To Your Advantage, in recent years the correlations in behavior have increased significantly. These once highly independent asset classes have started to rise and fall more in tandem with each other. As a result, IMCA argues, diversification into these various asset classes did not reduce downside risk during the 2008 downturn and losses were much larger than expected.

The reasons, pointed out by IMCA, include the following factors:

- risks within the financial system itself;

- global free trade;

- use of hedge funds, exchange-traded funds and derivatives;

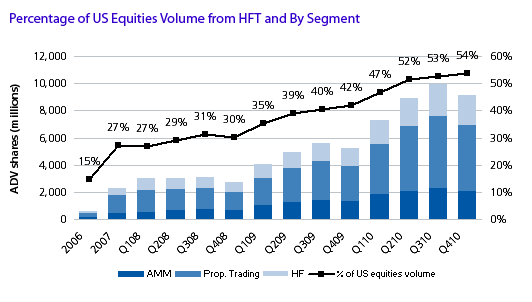

- and high-frequency trading.

The IMCA notes that according to Modern Portfolio Theory (MPT) and the theory of normally distributed returns, the October 2008 decline was a three-standard-deviation event that should occur roughly once every 9,000 months (i.e., 750 years). Even more astonishing they find, was the blowout in yields in October 2008. According to MPT, the yield spread between investment-grade bonds and U.S. Treasuries that month should occur once in the lifetime of the universe.

The financial system is a fragile and complex network of financial relationships that has built into it a tendency for periodic disturbances that can produce “huge, unanticipated changes,” which at times spin out of control into a catastrophe. This is the thesis Harvard professor Niall Ferguson put forth in his 2012 book The Great Degeneration, How Institutions Decay and Economies Die.

Will major overhauls to our financial regulatory system that Trump has insinuated, such as the repeal of Dodd Frank and the rolling back of the DOL’s Fiduciary Rule, trigger a systemic shock to markets? Won’t most of the factors contributing to rising correlation between asset classes likely continue during a Trump presidency?

Our Solution: Prep Your Portfolio for Trump In the wake of Donald Trump’s election and the heightened likelihood of at least some market disruption in the near-term, we are employing three sound strategies to protect our clients in the case of a downturn. Overall, these three moves offer a defensive growth strategy, based on a Socially Responsible, Impact-Oriented, Risk Parity model.

To learn more about our strategy to Portfolio Strategies for a Trump Administration, send us an email to attend our upcoming presentation: Risk Parity Impact (RPI®) Portfolios – a Defensive Growth Strategy or if you have any comments or questions about how a Trump Presidency might impact your financial life.

References

Renewable Energy Will Do Just Fine In President Trump’s America by James Conca, Forbes, 11/10/2016

The Great Degeneration, How Institutions Decay and Economies Die by Niall Ferguson