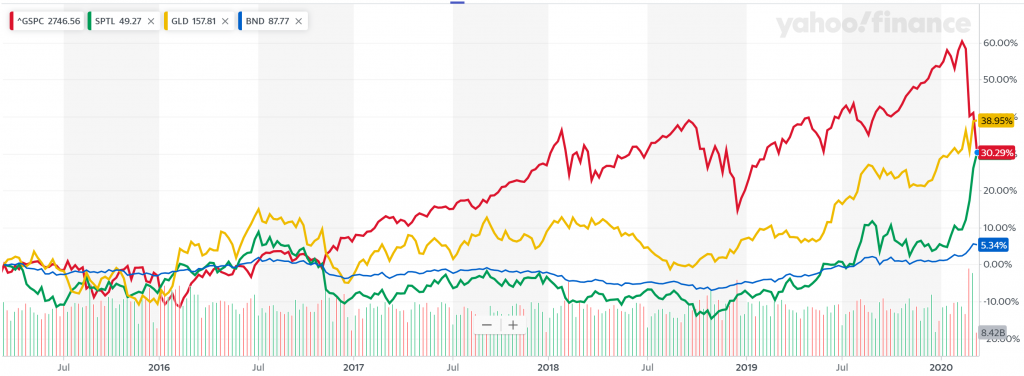

For perspective, below is a snapshot of the US Stock Market (^GSPC) vs Gold (GLD) vs Long Term Treasuries (SPTL) vs Bonds (BND) over the last Two and Five Years. Looking at the two year graph, you can see how obviously valuable it is to have a diversified portfolio, holding low-correlated assets such as Gold, Long Term Treasuries, and Bonds, all of which have significantly outperformed the US Stock market over this period.

TWO YEARS

FIVE YEARS

Observing the five-year graph, one of the fascinating narratives depicted is the sudden divergence of Long Term Treasuries from the US Stock Market in November 2016, during the last US Presidential election, with Gold dividing the two mirror performances, and an abrupt re-convergence of the three indexes just in the last week.

Corona Virus

The current market drop is definitely taking some wind out of many overpriced stock sails, which we have been preparing you for these last three years. In addition to pricing adjustments that are natural, normal and healthy toward the end of any expansionary cycle, we believe there is additional repricing taking place that is based on estimated disruptions in both supply chains and consumer demand (except for hand sanitizer and bleach) due to the Coronavirus.

In our modeling, we are taking the Coronavirus as a serious threat to both human well being as well as to financial returns. We’re estimating significant economic disruptions from over-strained health care systems to cancelled business and personal travel.

We also believe that, while the Coronavirus seems to be at serious risk of becoming a major global pandemic, because the death rate is so low, we’re currently estimating that society will eventually integrate into the fabric of society, finding ways to mitigate and manage the healthcare risk, and capitalism will continue. In other words, we’re not currently expecting the virus to create an immediate and total societal meltdown, although it’s probable our economy will loose a quarter or two of production this year.

That said, we are watching the markets closely, including the options markets, to estimate if this view should change. In the meantime, we are re-balancing portfolios, selling treasuries and gold to buy stocks at more discounted prices.

Additionally, for many who have been sitting on cash waiting for a market correction to buy in at lower prices, we are placing capital tactfully in this current period.

Perspective on Market Volatility

Back in 1987, right after the stock markets had experienced the famous “Black Monday” decline which took the Dow Jones Industrial Average down by 22.6%, the weekly Barron’s financial publication featured, on its cover, a suitcase with the frightened eyes of a Wall Street broker peeking out of its dark recesses, and an arm reaching out to wave a white flag.

After the worst market week since the 2008 financial crisis, and one of the worst months since the 1930s, that image represents how a lot of professional advisors are feeling right now. The market finished out a remarkably bad week of negative returns, including consecutive days of 1,000 point drops in the Dow and a February 1-month drop of 7.5% in the S&P 500 index. And there have been significant gains in the last few days.

Dramatic stock market movements in a short time-frame can be unnerving and cause for concern. Part of our role as investment advisors is to try to absorb the worst of client fears, including the great decline and significant volatility.

Key points to consider:

- We can’t predict how markets will move in the short-term, though we believe that they’ll grow over time.

- We remain committed to supporting you and all clients in investing with your time-frame, goals, and risk tolerance in mind.

- If we haven’t partnered with us on a financial and retirement plan, or if you’d like to review your existing plan, please let us know.

If you’re open to hearing a bit of good news, then consider that the actual value of the companies that make up the major indices are almost certainly not 10% less valuable today, as businesses, than they were last Monday. Even though there are definitely some real impacts of Coronavirus on many industries such as airlines and hotels, at least some of the market drop is likely a panic attack, and real valuations should eventually reassert themselves. The bad news is that neither we nor anyone else has any idea how long the panic attack is going to last, or exactly what the ultimate impact on the economy and market values will be in the future.

Even though a lot of attention has been given to the virus’s impact on the markets, the more important issue is the health of you and your family. You—like us—should be closely monitoring the spread of the disease. Most of us have heard that simple surgical masks won’t prevent wearers from getting the virus. Medical experts say that we should be conscientious about washing our hands, not touching our face, and using hand sanitizer and cleansing wipes.

Our wish is that you and your family will stay well, and that the virus will not become the pandemic that many (including market traders) are fearing. And please understand that we (and everyone else) don’t know what the market will do tomorrow or next week. The panic might continue, or we might experience a quick recovery.

Historically, the best plan when bear markets present themselves is to sit tight, consider rebalancing your investments, and avoid making decision based on short-term happenings in the market. Our goal for you is to follow the best plan we know and wait for the recovery.

Do not hesitate to reach out with questions, comments, concerns, or anything else on your mind.

Sincerely,

Impact Investors Team

—————-

Sources:

https://finance.yahoo.com/news/cornoavirus-mask-protection-195815084.html

https://finance.yahoo.com/news/medical-expert-on-coronavirus-dont-panic-prepare-for-the-worst-right-now-205533137.html

https://finance.yahoo.com/m/83aa838b-a266-3daf-9229-e67e94a7ba8f/cdc%E2%80%99s-coronavirus-test-bogged.html

https://www.medicalnewstoday.com/articles/256521#symptoms