Since late August there has been a significant sell-off in the stock market and as this post is being written, the S&P 500 and DOW prices on Yahoo Finance reflect a drop of 13.7% and 12.6% respectively from their May highs.

Given the sharp fall, we’d like to offer a brief summary of the recent market activity, along with some historical perspective and our 10 STRATEGIES to consider going forward.

HTTP://WWW.YAHOO.FINANCE.COM

While there are many factors that contribute to market performance, it seems that China’s economy is a main culprit for the recent drop, along with the possibility of rising interest rates which continues to generate uncertainty for both investors and borrowers here in the U.S.

To briefly summarize these two issues:

- China has been struggling mostly due to global economic slowdown. The Chinese government decided to change how their currency is valued in effort to make their exports more valuable. This, in turn, has devalued their currency, creating a tailspin in the markets.

- Additionally, there has been a lot said recently about interest rates starting to go up in the U.S. as early as September, however many believe this inevitable hike is already priced into the market, which is why it has not gone up as much as last year. The Fed may also change its position to help stimulate the economy (versus hurting it), and this could in fact stimulate buyers and boost consumer confidence.

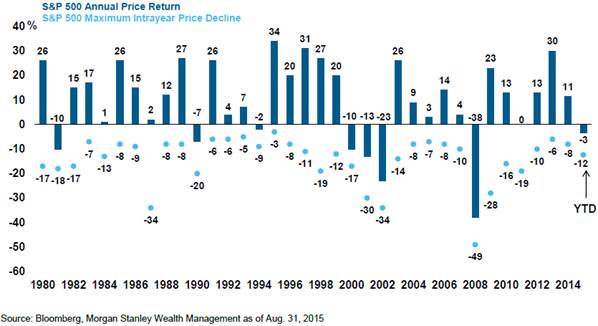

For some perspective, during the 34 years from 1980 to 2014, there were 19 years that saw daily declines of 10% or more, and in those years the market still finished with positive returns all but 6 times. Until recently in fact, 2015 was one of the stock market’s least volatile years since World War II (see chart below).

Furthermore, for long-term investments like those typically held in retirement accounts, it can be helpful to know that even in the 2008 meltdown, which was the worst since the Great Depression, stocks experienced full recovery within only 48 months from the start of their fall in October 2008, according again to Yahoo Finance’s published index values.

With that said, here are our 10 STRATEGIES to consider:

- Take advantage of downturns by harvesting losses or cutting capital gains taxes by selling low, particularly positions that you may not want in the long-term (potentially making this the Perfect Time to Consider SRI if you haven’t already);

- Remember that volatility is the price we have to pay for the returns we receive from equities. There is no such thing as a no-risk, high-return investment;

- Keep in mind the age-old advice: don’t put all your eggs in one basket… diversify! It can be beneficial to have some weighting in assets with a low correlation to the S&P, like publicly available illiquid alternatives that do not fluctuate in price as dramatically as stocks;

- Do not pull out when the market is down if you can help it, unless to harvest tax losses (see #1 above). Otherwise, stay invested for the long-term, which can be different for everyone but generally means at least 5-7 years;

- If you have short-term spending needs from your savings within the next 1-2 years, keep that “bucket” in a cash equivalent that you know will be there;

- If you have big expenses that will require withdrawals from your portfolio during the next 3-5 years, consider laddering short term municipal bonds with that portion;

- If you have cash on the side-lines, now may be a good time to dollar cost average into the market over next 2-3 years with the aim of buying in during a market correction, given we are at the peak of a 6-year run up in stock market;

- Use financial planning software (now available for you on-demand from our website) to project various future scenarios, determining how a bear market might impact your ability to achieve your objectives and which moves you can make to increase your probability of success;

- Rebalance portfolio holdings, effectively buying into sectors and stocks when they are at good bargains, adhering to the #1 Rule of Investing: buy low, sell high;

- Invest in sustainable, responsible companies, knowing that your money is also contributing to a positive social and environmental impact in the world.

As always, these are our general observations so please feel free to call with any questions or concerns related to your specific accounts and/or investments.

Investing involves risk. Depending on the different types of investments there may be varying degrees of risk. Clients and prospective clients should be prepared to bear investment loss including loss of original principal.